Activities Is the First Step in Applying Activity-based Costing.

The levels are a unit level. Compute the activity-based overhead rate per cost driv c.

Steps In Activity Based Costing Wikieducator

Identifying the activities Johnson company has the following overhead costs.

. Identify the cost driver that has a strong correlation to. Step 6- Find out the profit and loss. During step 3 of activity-based costing activity rates are used to assign overhead to products.

For each activity list resources used. Identify the indirect costs associated with each cost-allocation base activity. Step 1- Find out the activity related to the production overhead.

2 Assigning costs to activity cost centres ie. Uses activity based costing to determine the costs of its two products. The first step in using activity-based costing is to list all of the activities necessary in order to create your product.

The first step in activity-based costing is to a. Create a list of tasks your company performs to complete a job. Cost hierarchy is a framework that classifies activities based the ease at which they are traceable to a product.

Computing a cost rate per cost driver c. The first step in applying the activity-based costing method is a. Identifying the activities that consume resources d.

Activities causing overhead include all of the following. Historical Perspective on Determination of Manufacturing Overhead Allocation All products consist of material labor and overhead and the major cost components have historically been materials and labor. Identify the activities that consume resources and assign costs to those activities.

The first step is to identify and measure all of the costs incurred in carrying out specific activities. Each category of resource materials labour and equipment needs to analysed and assigned to the cost pool for a particular activity. Activity based costing for companies is all about devising the appropriate pricing strategy for identifying product costing product line profitability analysis target costing and service pricing strategies.

Identify and classify all of the activities in the value chain related to the production of the product. Heating and lighting 15000. Assigning costs to cost pools or cost centres for each activity.

Compute the rate per unit of each cost-allocation base yactivity used to allocate indirect costs to the products. Assigning costs to products. ____ Identifying Assigning Tracing activities is the first step in applying activity-based costing.

Example of Activity Based Costing. Assign overhead costs to products using overhead cost pool b. Identify Costs The first step in ABC is to identify those costs that we want to allocate.

The estimated total cost and expected activity for one of the companys three activity cost pools are as follows. Here are four basic steps used to create a cost code in activity-based costing. To simplify rather than calculating the indirect expenses of the company by pooling all costs together.

Identifying the factors that influence the costs of particular activities. This is the most critical step in the entire process since we do not want to waste time with an excessively broad project scope. 1 Identifying activities ie.

Select the activities and cost-allocation bases to use for allocating indirect costs to the products. Identifying the cost drivers b. 3 Selecting appropriate cost drivers ie.

Identify the cost drivers associated with each activity. We have here given two activities. The first step in applying activity-based costing is.

Activity-based costing ABC is the process that assigns overhead to products based on the various activities that drive overhead costs. Identifying assigning tracing activities is the first step in applying activity- based costing. Purchasing materials would be an activity for example.

Activity-based costing is a costing method based on the actual costs to design manufacture and sell a product. ____ Unit Batch Product activities are performed on each product unit. Activity-based costing requires accountants to use the following four steps.

Identifying Johnson company has the following overhead costs. Activity-based costing ABC can affect the cost distribution process in three ways. Identify the direct costs of the products Step 2.

Step 2- Identify the cost drivers for each and every activity. They are noted below. Assign overhead costs to products using overhead cost pool b.

One of their products a phone requires 20 setup activities at 50 per setup and 15 design modification activities at 1000 per design. Define each activity in such a way that theres no overlap between them. The activity rate under the activity based costing system for this activity is closest to.

Application of the cost of each activity to products based on its activity usage by the product. The first step in activity-based costing involves identifying activities and classifying them according to the cost hierarchy. The first step in using activity-based costing is to list all of the activities necessary in order to create your product.

The first step in applying activity-based costing is. Step 4- Absorption of activity into the product. The company assigns overhead costs which include direct materials direct labor.

If Mobile Company produces 2000 phones what is. Be sure to include both direct expenses such as materials as well as. Step 5- Now calculate the production cost.

Select all correct answers. Identifying major activities that take place in an organisation. Activity based costing is the process of assigning indirect costs in the form of salaries and utilities to different products and services.

Activity-based costing is best explained by walking through its various steps. The allocation of overhead costs is more accurate and precise as they are separated and grouped into pools based on the number of activities. What is the second step in activity-based costing.

You will need to determine. Who carries out the work and how much time they devote to it. So the drivers areas the number of machine setup would increase the cost would also increase and similarly as the number of inspecting hours increases that would lead to an increase in inspection cost as well.

And assembly line power 5000. Identify and classify the activities involved in the ma and allocate overhead to cost pools. Step 3- Calculate the cost driver rate of the activity.

Machine setup 25000 factory maintenance 10000 heating and lighting 15000 and selling expenses of 5000. The first one is a machine set-up activity and the second one is inspecting the same.

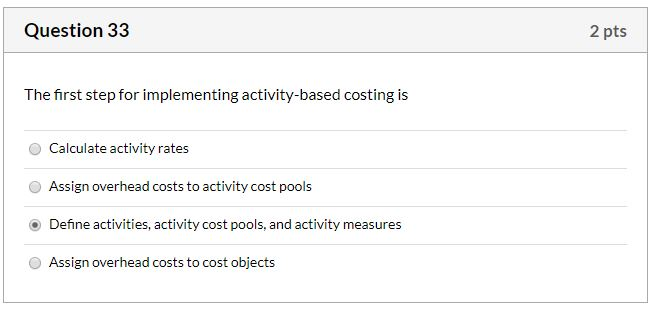

Solved Question 33 2 Pts The First Step For Implementing Chegg Com

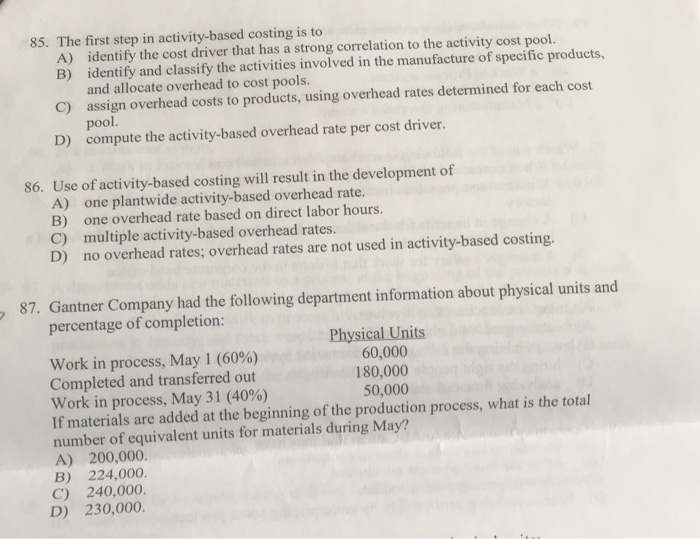

Solved 85 The First Step In Activity Based Costing Is To A Chegg Com

What Is Activity Based Costing Meaning And Suitability Finlawportal

No comments for "Activities Is the First Step in Applying Activity-based Costing."

Post a Comment